Part 1. Siemens — One of the Pillars of the Modern Electronic-Components Industry

In the modern industrial landscape, few names carry as much weight as Siemens. With roots tracing back to 1847 and a present-day presence in almost every industrial segment, Siemens AG stands as a powerhouse in automation, electrification, and digitalization. This article unpacks how the company evolved from a telegraph workshop into one of the world's most formidable players in electronic components, and why it continues to lead the charge in industrial innovation.

Origins: From Telegraphs to Power Systems

Siemens was founded in Berlin by Werner von Siemens and Johann Georg Halske in 1847 as "Telegraphen-Bauanstalt von Siemens & Halske." Their early work revolutionized communications across Europe and Russia through advanced telegraph systems. By 1850, Siemens was already operating internationally, setting the stage for its global trajectory.

Fast forward to 1966, multiple Siemens divisions were merged to form Siemens AG, consolidating its capabilities across electrification, industrial control systems, and emerging automation technologies. These early structural moves were instrumental in shaping the company’s integrated technology model.

Strategic Positioning: Automation Meets Digitalization

Siemens didn’t become a leader in electronic components by accident. It achieved this through strategic focus, decades of R&D investment, and timely acquisitions. While many conglomerates diversified to their detriment, Siemens streamlined.

The company split off its semiconductor business into Infineon in 1999, sold its mobile handset business, and shed unrelated divisions to zero in on digital industries, smart infrastructure, and healthcare technology. This sharpened focus helped Siemens become synonymous with industrial automation and control.

Notable acquisitions and partnerships include:

-

Mentor Graphics (EDA tools, 2017)

-

CD-adapco (simulation software, 2016)

-

Altair Engineering collaboration (simulation and design)

-

NVIDIA partnership to integrate AI into Industrial Operations X

-

Ebm-Papst drive technology division (announced 2024, closing expected in 2025)

These moves allowed Siemens to build an end-to-end digitalization portfolio anchored in its Xcelerator platform, which supports digital twins, IoT connectivity, simulation, and industrial AI.

Electronic Components: Core Product Domains

Siemens delivers a broad suite of industrial and infrastructure electronics. Key domains include:

1. Automation Systems

-

SIMATIC PLCs: from the early S5 series to today’s S7-1500, these programmable logic controllers remain the backbone of industrial automation.

-

Distributed I/O: ET200 series for modular signal acquisition and decentralized control.

-

Industrial PCs and HMI Panels: For machine interfaces and real-time control.

2. Drives and Motion Control

-

SINAMICS drives, such as the S120 and G120, enable dynamic, energy-efficient motion systems.

-

SIMOTICS motors: powering everything from compact pumps to large-scale industrial operations.

-

The integration of Ebm-Papst drive solutions further broadens the drive technology portfolio.

3. Smart Infrastructure Electronics

-

Building automation components for HVAC, lighting, and energy efficiency.

-

Low- and medium-voltage switchgear and distribution components.

-

Power electronics for data centers, smart grids, and electrification.

4. Digital Industry Solutions

-

Xcelerator: An open digital business platform for integrating hardware, software, and services.

-

Industrial Operations X: Real-time AI, simulation, and analytics.

-

Digital Twin & IoT Modules: Sensors, edge devices, and cloud integration.

5. Mobility Electronics

-

Traction systems and intelligent electronics for rail and transit.

-

Automation systems supporting real-time signaling, braking, and control.

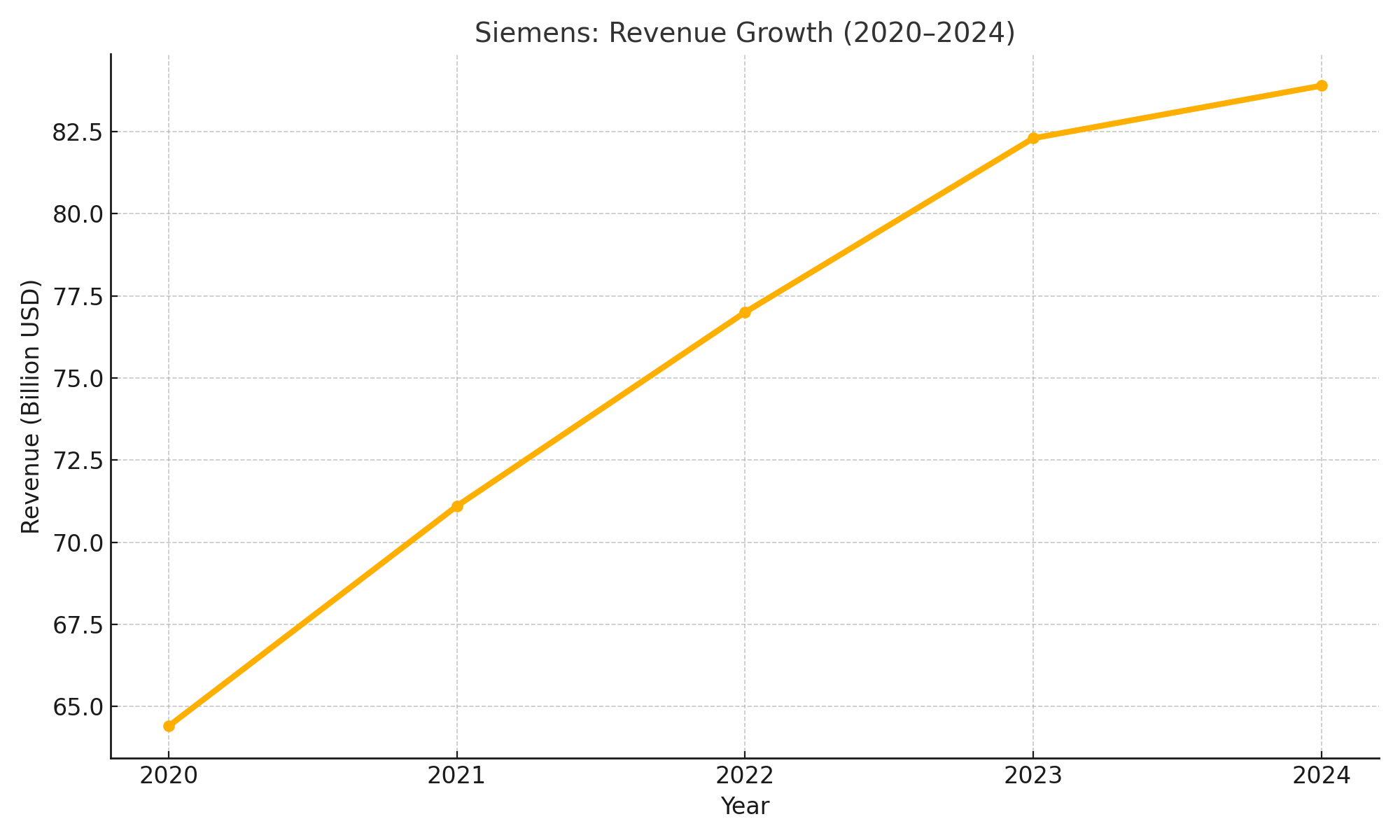

Siemens by the Numbers: Financial Powerhouse

The scale of Siemens’ operation is staggering. Let’s look at recent financials and market positioning:

Revenue Growth (USD billions)

-

2020: $64.4B

-

2021: $71.1B

-

2022: $77.0B

-

2023: $82.3B

-

2024: $83.9B

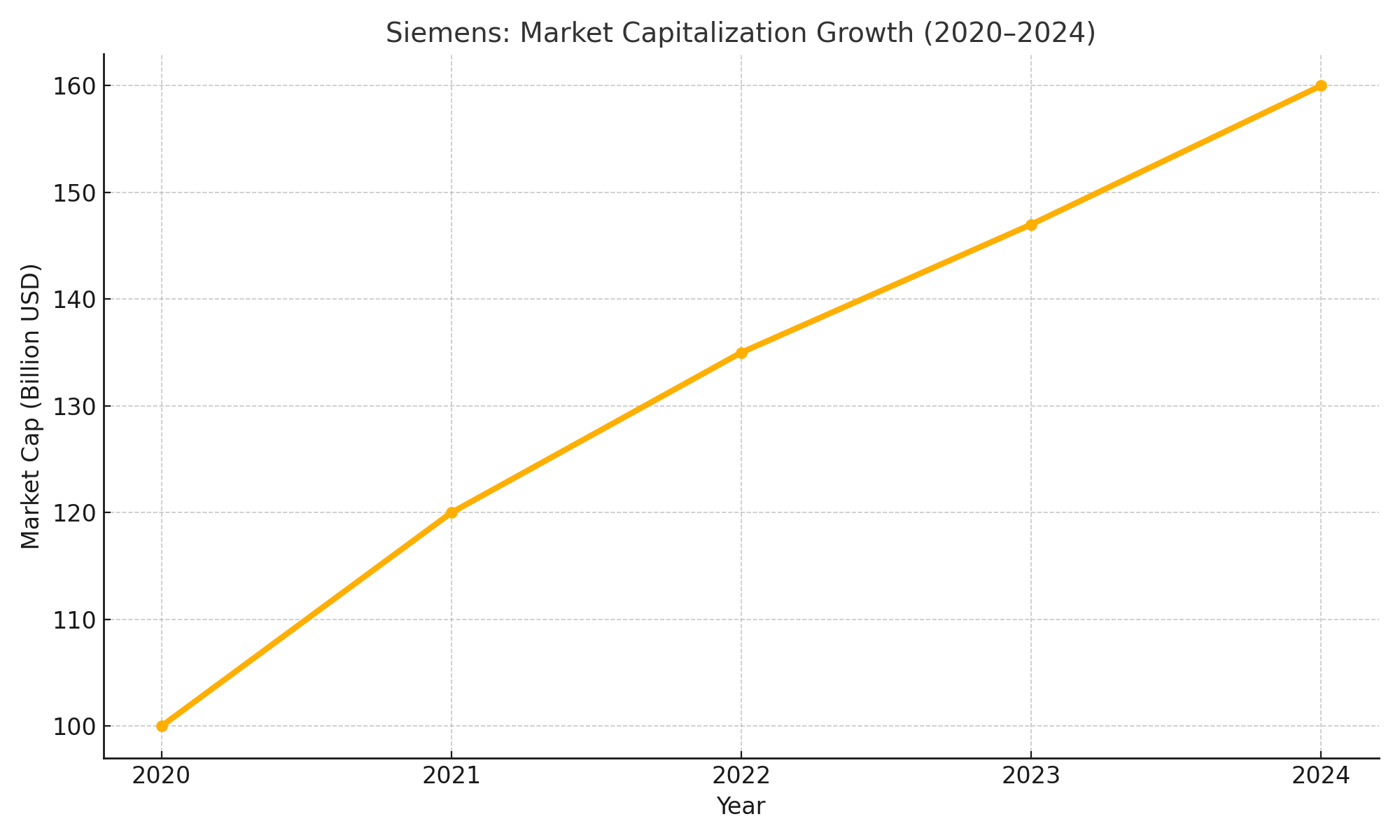

Market Capitalization Growth (USD billions)

-

2020: $100B

-

2021: $120B

-

2022: $135B

-

2023: $147B

-

2024: $160B

Fiscal 2024 Highlights:

-

Revenue: €75.9 billion

-

Net Income: €9.0 billion

-

Free Cash Flow: €9.5 billion

-

Employees: Approx. 327,000

Global Presence:

-

Operates in ~190 countries

-

285+ production/manufacturing facilities

-

U.S. operations revenue (2023): $21.2B

Long-Term Vision & Strategic Outlook

Siemens continues to push boundaries in the era of electrification and digitalization. Its roadmap includes:

-

AI-Ready Factories: Using Industrial Operations X and NVIDIA’s tech stack to bring AI to the edge.

-

Smart Grids: Next-gen power electronics supporting renewable energy, grid stability, and microgrids.

-

Data Center Electrification: 45% YoY growth in related revenue (H1 FY2025).

-

Sustainability Focus: Net-zero targets across its value chain, electrification-as-a-service initiatives.

-

Mobility Expansion: Major rail orders tripled to €7.94 billion in Q3 2025, signaling growing global infrastructure demand.

Final Thoughts

Siemens is more than a legacy industrial player. It has reinvented itself as a digitally native, automation-first company with hardware, software, and services tightly integrated across sectors. Its strength in electronic components—from sensors and drives to full automation stacks—makes it indispensable in global manufacturing, infrastructure, and mobility.

With a sharp strategic focus, robust financials, and a clear roadmap toward AI and electrified systems, Siemens stands as one of the true pillars of the modern electronic-components industry. And it’s far from done.

Sources available on request. Revenue and market data compiled from Siemens annual reports and public finance databases as of August 2025.